Buoyed by robust sales in Europe, bibigo plans to strengthen its product portfolio with Korean street food line-up

Earlier this month, CJ Foods’ bibigo brand set up a pop-up venue called bibigo-Zone or bibigo Sijang inside the Korea House on the sidelines of the 2024 Paris Olympics. CJ Group was the main sponsor at the largest-ever Korea House, a cultural pavilion aimed at showcasing Korean culture and providing assistance to Team Korea.

The pop-up venue, modeled after Korean traditional markets, sold five combo meals – chicken mandu, beef mandu, Korean-style corn dogs, plant-based kimchi mandu and plant-based bulgogi rice balls – all served with the bibigo brand kimchi and tteokbokki.

The event received an overwhelming response, with 500 portions of bibigo items sold out everyday within just four hours of opening – a tidal moment that confirmed bibigo that its expansion strategy would be a success.

In this feature, we delve into the company’s strategy for the European market.

Increasing Cravings for K-Cuisine

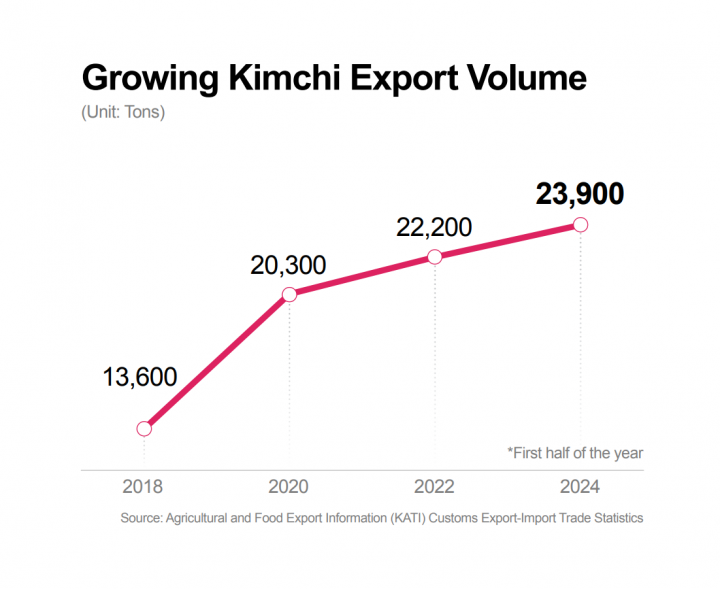

Looking at the overall demand for K-food around the globe, the amount of export for kimchi in the first half of this year hit a record high.

Korea exported a total of 23,900 tons of kimchi during this period, according to KATI, the statistics arm of the Korea Agro-Fisheries & Food Trade Corporation, and Korea Customs Service. The figure is a 4.8% increase from the same period last year. When compared to the same period in 2015, the number has more than doubled.

Exports to North America and Europe increased in a meaningful way. Notably, kimchi exports to the United States reached 6,600 tons in the first half of this year, a 20% jump year-on-year. The figure for the Netherlands hiked up 34% in the same period to 1,300 tons.

Looking at the overall demand for K-food items including kimchi, the demand for ramyun, ready-to-eat rice products, drinks and more increased significantly in the States on the back of the bullish consumer sentiment in the world’s largest economy.

Over in the ASEAN region, new distribution channels helped the sales hike. Korean convenience store and bakery chains have entered the market for the 10-member states of the Association of Southeast Asian Nations in the last couple of years.

The fastest growth, however, is seen in Europe, with a 33% increase year-on-year when comparing the cumulative exports from last March to early April this year.

Europe as Emerging Market for K-food

While K-food has been slowly gaining popularity worldwide in the last decades, it didn’t enjoy much luck in Europe until recently.

Over the course of the past four years from 2020, CJ Foods’ exports to Europe saw an average growth rate of 38%. Not only that, the company’s sales in Europe in 2024 Q1 jumped 45% from the same quarter last year. Looking at the latest time frame, European sales skyrocketed 57% on-quarter in 2024 Q2.

Experts say the increasing appetite for K-food is closely related to the rising interest in K-content; in a region where Japan has traditionally enjoyed the stronghold.

CJ Foods’ foray into the European market began in 2018, when it acquired German frozen foods company Mainfrost, which is now operating as the food giant’s European production and R&D headquarter as CJ Mainfrost Foods GmbH. In 2022, it established a legal entity in the United Kingdom; and a French one this May.

From Consuming K-Content to K-Food

The decision to establish a corporate body in France this year came on the back of rising demand for K-food there. For instance, there are approximately 350 Korean restaurants in the capital Paris alone. France is an attractive market for CJ Foods, as the country boasts the third-largest GDP, as well as the second-largest processed food market, in Europe.

CJ Foods is betting on the increasing exposure of K-content to European users to whet their appetite for Korean street foods. As such, the company’s aim is to have mandu become one of the top 10 favorite food items among the French, followed by tteokbokki, rice balls, Korean-style corn dogs and more.

The Korean food manufacturer is also adapting to the European tastebuds by utilizing chicken to replace beef or pork whenever necessary; and incorporating plant-based ingredients for vegans and vegetarians.

Getting To the First Bite

While European customers seem keen to try Korean cuisine, they have limited access to high-quality processed K-food products, which is the basis from which CJ Foods engineered its regional strategy.

The first step of the business for CJ Foods is to help European customers discover and experience the bibigo items firsthand. The company plans to launch aggressive marketing activities for such accessibility by setting up pop-up stores and tasting events throughout the region.

In addition, a rapid expansion of its distribution channel is also part of the plan. In Germany, where bibigo mandu carved out a whopping 48% market share in the dumpling sector, it has partnered with Edeka, the country’s top supermarket, along with Globus, Tegut, REWE and Amazon. In the U.K., the Netherlands and Belgium, its products are available in major grocery stores such as Sainsbury’s, Albert Heijn and Carrefour.

Judging by the success of the bibigo-Zone at the Korea House and the rapidly growing demand for mandu over the past few years, it’s just a matter of time until customers in Europe discover the whole smorgasbord of Korean flavors that CJ Foods has to offer.