The Fourth Korean Wave is in full swing in Japan, marked by the growing consumption of K-culture. While K-pop and media content have traditionally led the movement, Korean cultural influence is now expanding across all generations and diverse sectors, including food and cosmetics.

What do foreigners really think about Korean food? Do they find it tasty? We came to pose the question: Is K-food truly popular in the global market?

To find out, we spoke with Im Mu-gyeol from CJ Foods Japan. Since joining the company in 2013, Mu-gyeol has worked in Korea, Japan, and Vietnam, strategically navigating local consumer preferences at the frontline of the company’s quest on global expansion.

Q. Tell us about yourself.

Hello. I’m Im Mu-gyeol, a man on a mission to enhance K-food’s value by addressing global consumer and market issues.

Working as a Brand Manager (BM) and Product Manager (PM) across Korea, Japan, and Vietnam, I’ve been responsible for developing and executing business strategies based on market and consumer insights.

In 2023 I returned to Japan to join the Category Division, which oversees overall business growth—from strategy development, new product planning, brand management, campaign execution, to profit and loss control.

Q. This is your second time working in Japan. Has the Japanese perception on K-food changed since your last time here?

Until 2019 Korean food in Japan largely revolved around flashy, visually striking street menus like cheese dakgalbi (spicy stir-fried chicken) and Korean-style corndogs. The main consumers were Korean Wave fans in their teens and twenties who were into one-time experiences and social media sharing. Korean food was also only available in specific districts such as Tokyo’s Shin-Okubo.

Lately, however, Korean food has been positioning itself as a more refined and mainstream culinary culture in Japan. Traditional dishes like bibimbap and bulgogi are gaining traction, alongside the growing presence of Korean-style desserts, beverages, and baked goods. The consumer base has broadened as well. Once a niche and narrow segment, Korean food is now reaching people of all age groups. It’s especially encouraging to see Korean cuisine being embraced not only by fans of Korean content but also by people of various genders and generations as a sustainable and everyday dining choice.

Q. So, is Korean food cruising in Japan?

Unfortunately, we do have one more challenge to tackle. We still need to get Japanese consumers to enjoy Korean food at home with packaged products. While a growing number of Japanese diners are going to Korean restaurants, not as many are enjoying Korean food at home. One study shows 50% of Japanese women in their 20s to 40s have had Korean food at a restaurant in the past three months. While 60% of the Japanese women in their 20s say they like Korean food, only 30% enjoy it at home.

That’s why bibigo is dedicated to translating the experience of dining out on K-food into household meals. We prioritize values Japanese consumers consider important, which are cost-effectiveness and time-efficiency. By offering RTH (ready-to-heat) products like dumplings and gimbap and RTC (ready-to-cook) products such as the bibimbap meal kit and bulgogi sauce, we’re making Korean food easy for everyone to cook and enjoy.

Q. Korean dumplings and Japanese dumplings are similar yet different. How do Japanese consumers perceive the Korean dumplings?

In Japan, dumplings are typically prepared mushiyaki-style—pan-frying the bottom while steaming the top. Our competitors are targeting consumers with convenient gyoza products that enable oil-free, water-free mushiyaki-style cooking.

In contrast, bibigo Mandu is optimized for a variety of cooking methods, including steaming, pan-frying, and deep-frying. It also stands out from Japanese gyoza with its generous stuffing, wholesome ingredients, and larger size. Fueled by culturally open-minded consumers, these unique features are helping bibigo Mandu carve out a growing new category in Japan’s market—Korean-style dumplings.

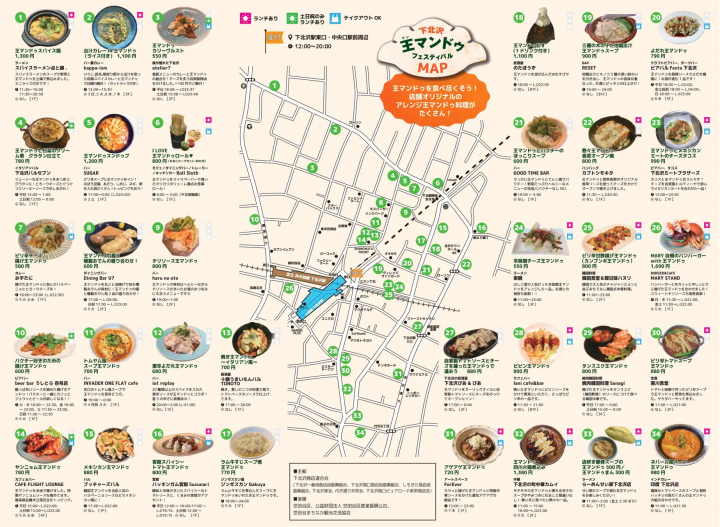

Last year, bibigo partnered with restaurants in Tokyo’s trendsetting Shimokitazawa neighborhood to introduce fusion dishes featuring bibigo Mandu. The dishes, which spanned Korean, Japanese, Chinese, Western, and other ethnic cuisines, were met with enthusiastic response. The unique concept and fusion approach sparked organic buzz on social media, significantly boosting the brand’s visibility.

That would be the bibigo Gimbap. Though gimbap is well known in Japan, consumers find it difficult to make at home since the recipe requires a lot of steps to prepare. Because there is high demand in Japan for microwaveable meals, we saw this as an opportunity and chose bibigo Gimbap as the first product to launch in the Japanese market.

With bibigo Gimbap, we struck a balance between familiarity and flavor by incorporating well-known Korean dishes like bulgogi, bibimbap, and kimchi while also adjusting the seasoning of the rice to suit the Japanese palate. The result? bibigo Gimbap has taken the Japanese market by storm, selling around 2.5 million products last year.

What’s especially noteworthy is that this product has demonstrated strong potential for global expansion. It is currently being exported to countries like Australia, Taiwan, and Singapore. In Australia, it’s part of the regular lineup in around 1,000 Woolworths stores. bibigo Gimbap is receiving praise from local consumers as a convenient microwaveable Korean meal.

This is a prime example of successfully identifying and swiftly responding to market needs. It is also proof that K-food is expandable at a global scale. As for the next contender after dumplings and gimbap, we are now turning our attention to jijimi, a Korean-style savory pancake.

Q. Can K-food grow further in Japan?

Japan and Korea share a culinary culture centered around rice. We also share parallel food traditions—like gimbap and onigiri, bulgogi and sukiyaki, jjigae and nabe.

These similarities present a valuable opportunity for penetrating the Japanese market with Korean food. Proposing entirely unfamiliar dishes often comes at the cost of high entry barriers. Delivering value by adding a unique twist to familiar foods, on the other hand, allows for faster market penetration with greater resonance and acceptance. bibigo Mandu is a great example, having gained attention in Japan’s ready-to-cook gyoza market by positioning itself as a healthier Korean alternative.

Going forward, I plan to continuously deliver the value of “novelty within familiarity” to Japanese consumers, while identifying new key products with potential. Through these efforts, I hope to help make K-food a part of the everyday food culture—not just in Japan, but around the world. Stay tuned to find out what CJ CheilJedang has in store.