Olive Young surpassed over 9 million transactions from global tourists across 189 countries in 2024

Global tourists from 189 countries have visited Olive Young stores in South Korea over the past year.

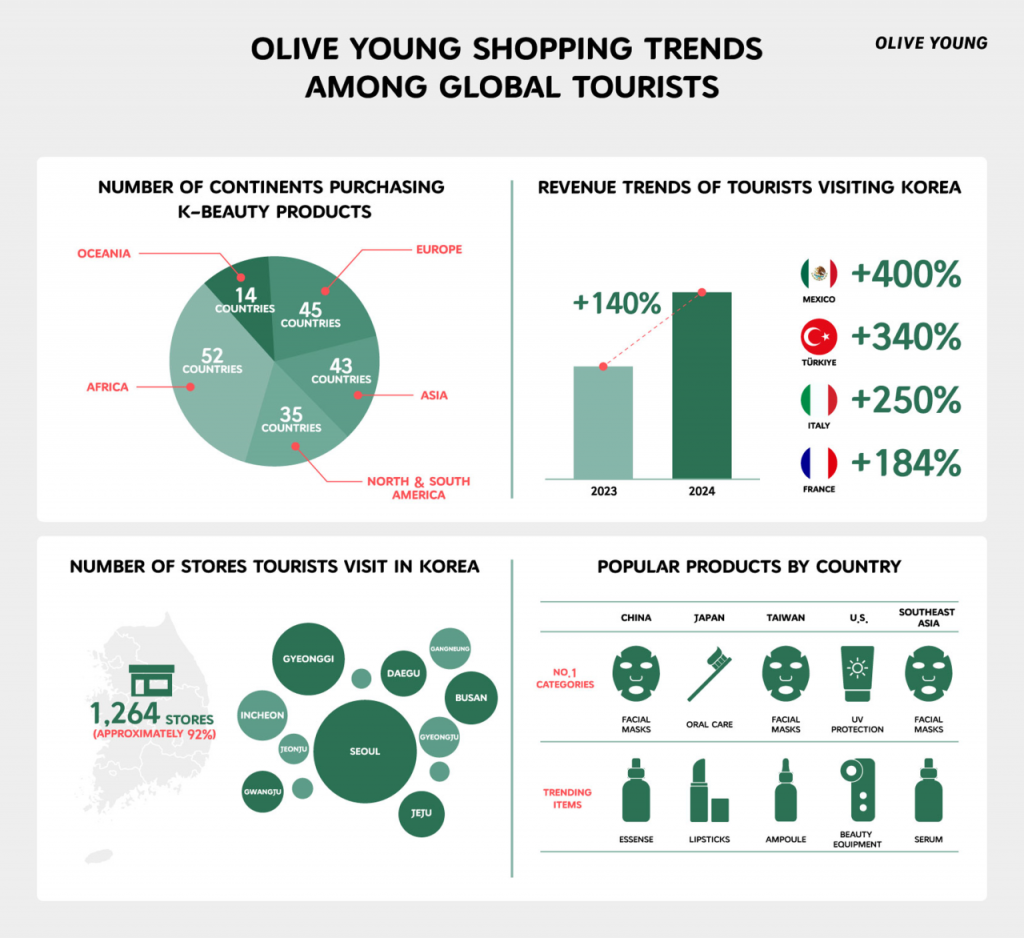

According to CJ Olive Young, international customers from 189 countries made a total of 9.42 million purchases at 1,264 Olive Young stores—covering approximately 92% of all locations—in 2024. Considering there are 193 UN members, this means customers from nearly every country, except those with limited outbound tourism, have shopped at Olive Young. This demonstrates that the popularity of K-beauty transcends specific regions and markets, resonating with a truly global audience.

European Sales Soar, while UV Protection Dominates the U.S. Top 10

Olive Young is now a “tourist must-visit,” with its global customer sales surging 140% year-over-year in 2024. The most significant growth came from European countries; sales from Italian and Spanish customers grew by 250% and 226% respectively, while even France, which has long dominated the beauty market, saw a remarkable 184% increase. Beyond Europe, the K-content wave, or “Hallyu,” continues to fuel interest in K-beauty, with sales from Mexico and Türkiye skyrocketing by 400% and 340% respectively.

In the U.S., UV protection products accounted for half of the top ten best-selling items, driven by growing consumer awareness of sun safety as the U.S. Food and Drug Administration (FDA) promoted the use of sunscreen to prevent skin cancer. Amid such an increase in demand, Korean sunscreen products have gained popularity for their affordability and effectiveness, further driving demand. Online search trends also reflect this growing interest; search volumes for terms like “Sunblock” and “Sunscreen” have risen, while the keyword “Suncream,” a term more commonly used in Korea, has seen a 50% increase over the past five years, highlighting the global influence of K-beauty terminology.

Analysis of international customers’ shopping habits suggests that K-beauty trends, such as the pursuit of “Glass Skin,” a term referring to the translucent, luminous skin associated with Korean skincare, are influencing purchasing behaviors. This trend is especially evident in East Asian countries like China, Japan and Taiwan, where shoppers are expanding beyond staple items like facial masks (sheet masks) and toner-lotion sets to include serums, ampoules and essences, core products in Korean skincare routines. The growing popularity of the term “Korean Skincare Routine” on social media further underscores how Korea’s unique approach to skincare is evolving into a globally recognized consumer culture.

Beyond Borders: Expanding K-Beauty for a Global Audience

This year, CJ Olive Young aims to elevate the shopping experience for international customers with a tourist-friendly marketing strategy.

Building on the success of Olive Young Myeongdong Town, where international customers make up over 90% of shoppers, the company plans to expand its specialized services to key tourist destinations such as Busan and Jeju Island. Multilingual services will be enhanced across various interfaces, including electronic labels, in-store guidance and checkout areas. Dedicated display sections like “K-Beauty Now” and “Global Hot Issue” will showcase trending K-beauty products and emerging brands that are popular with international visitors. Additionally, select multi-level stores with high-volume transactions will offer a luggage storage service for added shopping convenience.

To strengthen its engagement with global customers, CJ Olive Young is significantly expanding its Global Language Course (GLC), an in-house language training program available both online and offline for Olive Young staff. This initiative aims to improve communication with international customers while fostering global Customer Service (CS) specialists who can actively recommend products tailored to diverse regional preferences.

To sustain consumer interest in K-beauty even after returning home, CJ Olive Young is expanding the installation of vending machines, facilitating Olive Young Global Mall sign-ups. Currently available at Gwangbok Town, Myeongdong Station, Myeongdong Town and Samseong Town, these machines attracted over 330,000 new members last year alone.

A CJ Olive Young representative stated, “Olive Young is committed to providing international visitors with a positive shopping experience while serving as a Global K-Beauty Gateway that introduces emerging K-beauty brands to the world.” They added, “We will continue our efforts to integrate K-beauty into Korea’s tourism experience, alongside K-pop and K-food.”