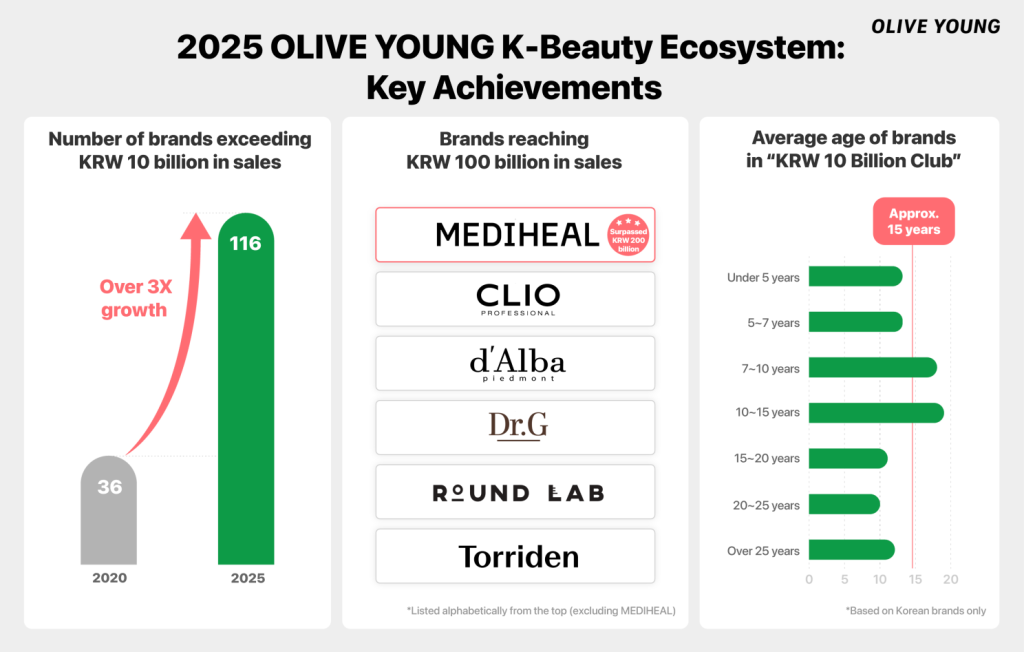

Olive Young, Korea’s leading beauty and wellness retailer, announced that 116 K-beauty brands recorded annual sales exceeding 10 billion KRW (approximately 7.5 million USD) across its offline stores and online platforms in 2025.

This milestone represents more than a threefold increase in just five years, up from 36 brands in 2020. The growth underscores Olive Young’s expanding role as a key incubator for both emerging and established K-beauty brands, while highlighting the industry’s long-term growth potential.

Billion-Won Brands Continue to Expand

In 2025, six brands surpassed 100 billion KRW (approximately 75 million USD) in annual sales at Olive Young, doubling the number recorded the previous year. These brands include Dr.G, d’Alba, Round Lab, MEDIHEAL, CLIO and Torriden (listed alphabetically).

Among them, MEDIHEAL made history as the first brand in Olive Young’s portfolio to exceed 200 billion KRW in annual sales, driven by the global popularity of its mask packs and toner pads.

A Diverse Brand Ecosystem, From Rising Stars to Legacy Leaders

Brands in the “10 billion club KRW” have an average business history of approximately 15 years, spanning a wide spectrum from rookie brands under five years old, such as Muzigae Mansion and fwee, to heritage brands with over two decades of history, including AROMATICA and Cell Fusion C.

This dynamic combination of innovation from new entrants and accumulated expertise from long-established players continues to generate positive momentum, reinforcing K-beauty’s reputation as a market defined by both creativity and resilience.

Beauty Devices and Medical Beauty Gain Momentum

Medicube AGE‑R newly joined the 10 billion KRW club, benefiting from growing global interest in Korean-style skincare routines and rising demand for beauty devices among international visitors.

Meanwhile, Rejuran reported that international customer sales accounted for more than 50% of total revenue, securing its place in the 10 billion KRW club for the second consecutive year amid sustained growth in beauty tourism.

New Concepts Drive Category Innovation

Olive Young also highlighted the success of concept-driven indie brands such as Arencia, known for its rice-cake-inspired cleanser textures, and Whipped, a brand inspired by cake recipes.

Backed by Olive Young’s skincare category curation strategy, these brands helped pioneer the “pack cleanser” segment, reshaping how consumers approach cleansing routines.

Nurturing the Next Generation of Global Brands

Meaningful results are also emerging from Olive Young’s venture incubation program, K‑Super Rookie With Young, which is designed to identify and scale next-generation global beauty brands.

Among the 25 brands selected in August 2025, Ongredients entered the 10 billion KRW club for the first time, while Menokin and 2aN surpassed 5 billion KRW in annual sales, positioning themselves as promising future leaders.

Omnichannel Infrastructure Fuels Scalable Growth

At the foundation of this broad-based growth is Olive Young’s robust omnichannel infrastructure, which seamlessly connects nationwide offline stores with its digital platforms, including the Olive Young Global app and website.

Flagship stores in major tourist districts also serve as global showrooms and real-time testbeds, enabling brands to validate international demand before expanding overseas.

U.S. Market Entry Accelerates Global Expansion

In the first half of this year, Olive Young plans to open its first offline stores in the U.S., the world’s largest beauty market. Through its distinctive curation and retail expertise, the company aims to support K-beauty and wellness brands along with high-potential partner brands in scaling into globally recognized names.